You are an HR Practitioner working in a company which offers an employer-sponsored Pension Plan (or a retirement savings and benefits plan.) Your employees don’t quite understand how it works, but neither do you, to be honest. This is a tricky area which combines legal and financial elements but it’s not as if you studied this topic at college…

Almost everything you learned has been on the fly, yet you are the one who must address employees’ uncertainty. How they choose to participate at the start, and what they receive when they exit – you are the one who must inform them accurately about their decisions and its results.

If you make a mistake, the consequences can be dire…late in life when they are most in need.

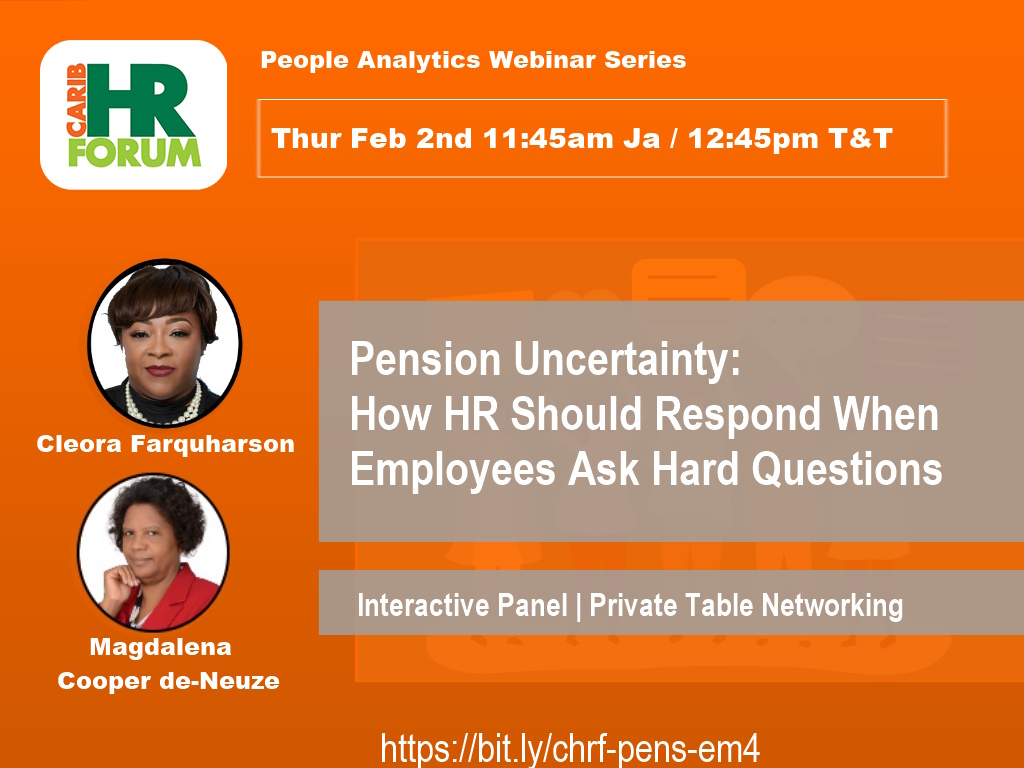

You take this responsibility seriously, which is why we’re having this webinar. It features two regional experts: Cleora Farquharson from RF Merchant Bank & Trust (Bahamas) and Magdalena Cooper-de Neuze from Milestones and Lifestyle Planning Services (Jamaica).

With over 50 years of combined expertise in Retirement Savings and Benefits Plans, they will cover the two most important moments for pension conversations: onboarding and offboarding. Laws informing these discussions vary between Caribbean countries, and are also changing due to COVID – facts they will address.

Come and update your knowledge. Don’t be stuck with outdated notions that don’t prepare you for a fast-changing, cross-regional future.

Thur Feb 2nd 2023 – 11:45am Ja / 12:45pm T&T

https://bit.ly/chrf-pens-web-event1 – your link to pre-register

Cost: Complimentary Lunch-n-Learn

After the webinar is over, you can stay around to ask questions of our experts and also meet other practitioners in this area…all courtesy of our Online Lounge.

Please share this webinar with your colleagues involved in retirement savings and pension income benefits. Such opportunities are rare on this topic.